With Black Friday and Cyber Monday behind us, the United States is well into the second holiday shopping season under a significant supply chain crisis.

While the situation has improved in recent weeks, the emerging Omicron variant of COVID-19 has led to new concerns about the supply chain. On Monday, President Biden was scheduled to meet with the CEOs of leading U.S. retailers in an attempt to stay ahead of any potential supply chain issues caused by the new variant, which has already begun to cause travel restrictions.

The potential impact of the Omicron variant is another example of the volatility of a global supply chain, that is already suffering from

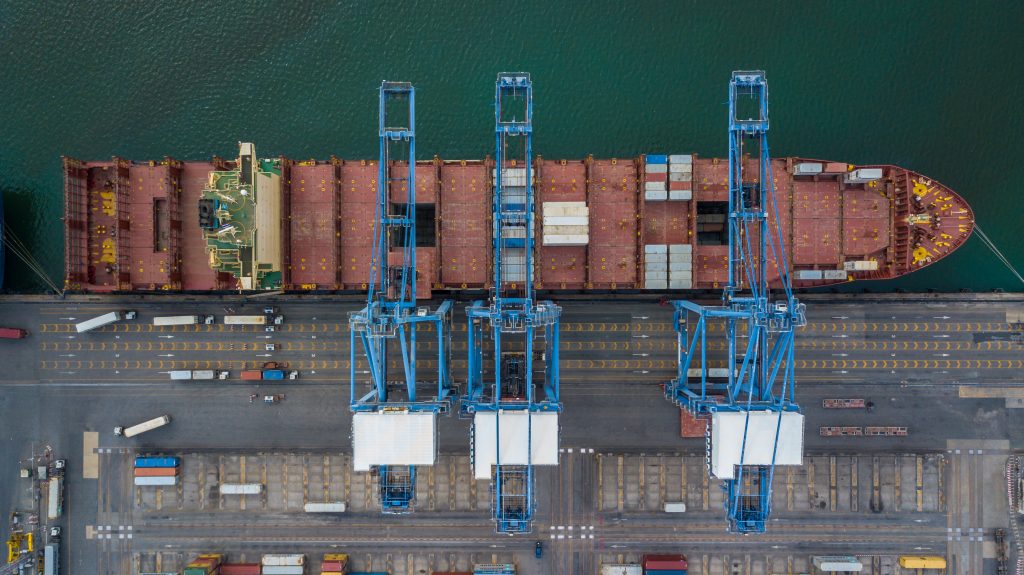

- Lingering backlogs at key the ports of Long Beach and Los Angeles

- An ongoing shortage of shipping containers

- Unprecedented surges in raw material pricing

- The impact of Trump administration tariffs

- Soaring freight rates

And though it may be hard to believe, rates for containers may go even higher than they are today. Several shippers stated that the industry has broken through the $30,000 cost per container ceiling, and rates may go up again as the ocean carriers look to include accessorial charges such as a “port congestion fee” per container to address the delays in being able to clear containers through the ports.

Which brings us to one of the most significant issues impacting the global supply chain – the monopolistic natures of the shipping industry. Around 70-80% of global shipping capacity is divided among three alliances, and those alliances have ramped up pricing to such an extent that many major retailers are leasing their own container ships to prevent price gouging.

At the recent Council of Supply Chain Management Professionals (CSCMP) Annual Conference, the presentations and conversations made it clear that this crisis is not going away any time soon. Virtually every expert at these sessions predicted that shippers should expect turbulent waters for at least the next 6 to 9 months if not throughout all of 2022.

What can be done?

Operating successfully in the current environment will require new thinking and creative approaches.

Perhaps the most important thing you can do right now is pay close attention to your sourcing and supply chain vendors and partners. Conditions are changing daily. It’s imperative you are aware of the current situation and have a system in place to forecast delays in the weeks and months ahead.

Additionally, this is also a good time to consider diversifying your supply chains so that you have multiple sourcing options when you need to respond to shortages and issues. According to a recent Lex column in the Financial Times, “those companies with the greatest scale and production flexibility will distinguish themselves from their rivals that cannot keep up.”

If you are sourcing in Asia, it is also time to seriously explore moving from “just in time” supply chains (moving material just before it’s needed) to “just in case” supply chains (keeping large quantities of inventory on hand). Maersk CEO Soren Skou, whose company carries 20% of the world’s sea freight, has cited low interest rates as a reason for companies to consider this change.

Sourcing as a Strategic Weapon

With a diverse and complicated array of challenges weighing down the global supply chain, now, more than ever, it is time to see sourcing as a strategic weapon.

Many of Blackford’s portfolio companies rely heavily on Asian imports, so we have developed an approach that gives us an edge in managing supply chains and ensures we’re better prepared to survive disruptions.

Blackford acquired Aqua Leisure, a global leader in aquatic products such as floats, lounges and goggles, in 2020. Immediately after the acquisition, Blackford began exploring ways to address the wide array of issues facing the global supply chain. We installed a Board of Directors with decades of global retail sourcing experience and enhanced an already robust sourcing platform with key hires and ongoing “cross-training” skills sessions. We also began identifying add-on acquisitions that could provide additional sourcing channels and purchasing power via increased product volumes.

A critical part of Aqua Leisure’s approach is its investment in “boots on the ground” in Asia. With more than 50 people working in Hong Kong and Shanghai, the company has been able to build key relationships across the supply chain. These relationships are critical to success in sourcing as they allow us to become priority customers. Our “boots on the ground” also ensures:

- The elimination of supply chain “middlemen”

- The continuity of supply and inventory

- Superior information flow to end customers, ensuring minimization of unpleasant surprises, and highly accurate order management and forecasting

- Realistic price negotiations that achieve an optimum outcome for Blackford portfolio companies

As a result of this strategic approach to sourcing, Aqua Leisure was able to deliver 98% of its shipments on time and complete during the height of the COVID-19 outbreak.

It’s clear that the current challenges are going to persist for the foreseeable future. Right now, to mitigate supply chain risk in the short-term, paying close attention to sourcing can help you plan for the worst – and help you deliver value for both your customers and your company.

Steve Feniger has been an Operating Partner at Blackford Capital since 2020. He’s an internationally experienced CEO who’s led an IPO on the HK Stock Exchange and works with western brands and retailers to professionalize their buying and sourcing operations in Asia.